after tax income calculator iowa

Corporations in Iowa pay four different rates of income tax. Appanoose County has an additional 1 local income tax.

2022 Iowa Farm Income Tax Webinar

Your average tax rate is 1069 and your marginal tax rate is 22.

. Compound Interest Calculator Present. Tax March 2 2022 arnold. Additional withholding cannot exceed your taxable wages less your federal withholding for a pay period.

Just enter the wages tax withholdings and other information required. If you make 55000 a year living in the region of Iowa USA you will be taxed 11457. That means that your net pay will be 43041 per year or 3587 per month.

After Tax Income Calculator Iowa. The Federal or IRS Taxes Are Listed. Filing 4000000 of earnings will result in 155590 of your earnings being taxed as state tax calculation based on 2022 Iowa State Tax Tables.

This results in roughly 7656 of your. The top marginal rate of 98 will remain in place until 2022. The Iowa Income Taxes Estimator Lets You Calculate Your State Taxes For the Tax Year.

Many of Iowas 327 school districts levy an income surtax that is equal to a percentage of the Iowa taxes paid by residents. So the tax year 2022 will start from July 01 2021 to June 30 2022. Tax March 2 2022 arnold.

Financial Facts About the US. The average monthly net salary in the United States is around 2 730 USD with a minimum income of 1 120 USD per month. The Iowa Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Iowa State Income.

United States Italy France Spain United Kingdom Poland Czech Republic Hungary. Use ADPs Iowa Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. If you would like to update your Iowa withholding.

However the rates will be gradually reduced to meet the revenue. 15 Tax Calculators. After Tax Income Calculator Iowa.

This places US on the 4th place out of. That means that your net pay will be 43543 per year or 3629 per month. If you make 55000 a year living in the region of New York USA you will be taxed 11959.

You can alter the salary example to illustrate a different filing status or show. Fields notated with are required. Calculating your Iowa state income tax is similar to the steps we listed on our Federal paycheck calculator.

After Tax Income Calculator Iowa. Iowa Income Tax Calculator 2021. After Tax Income Calculator Iowa.

Calculate your net income after taxes in Iowa. You can alter the salary example to illustrate a different filing status or show. The Iowa Income Taxes Estimator.

If you make 62000 a year living in the region of Iowa USA you will be taxed 11734.

Iowa Salary Calculator 2022 Icalculator

Where S My Refund Iowa H R Block

![]()

Free Hourly Payroll Calculator Hourly Paycheck Payroll Calculator

How Do State And Local Individual Income Taxes Work Tax Policy Center

1099 Tax Calculator How Much Will I Owe

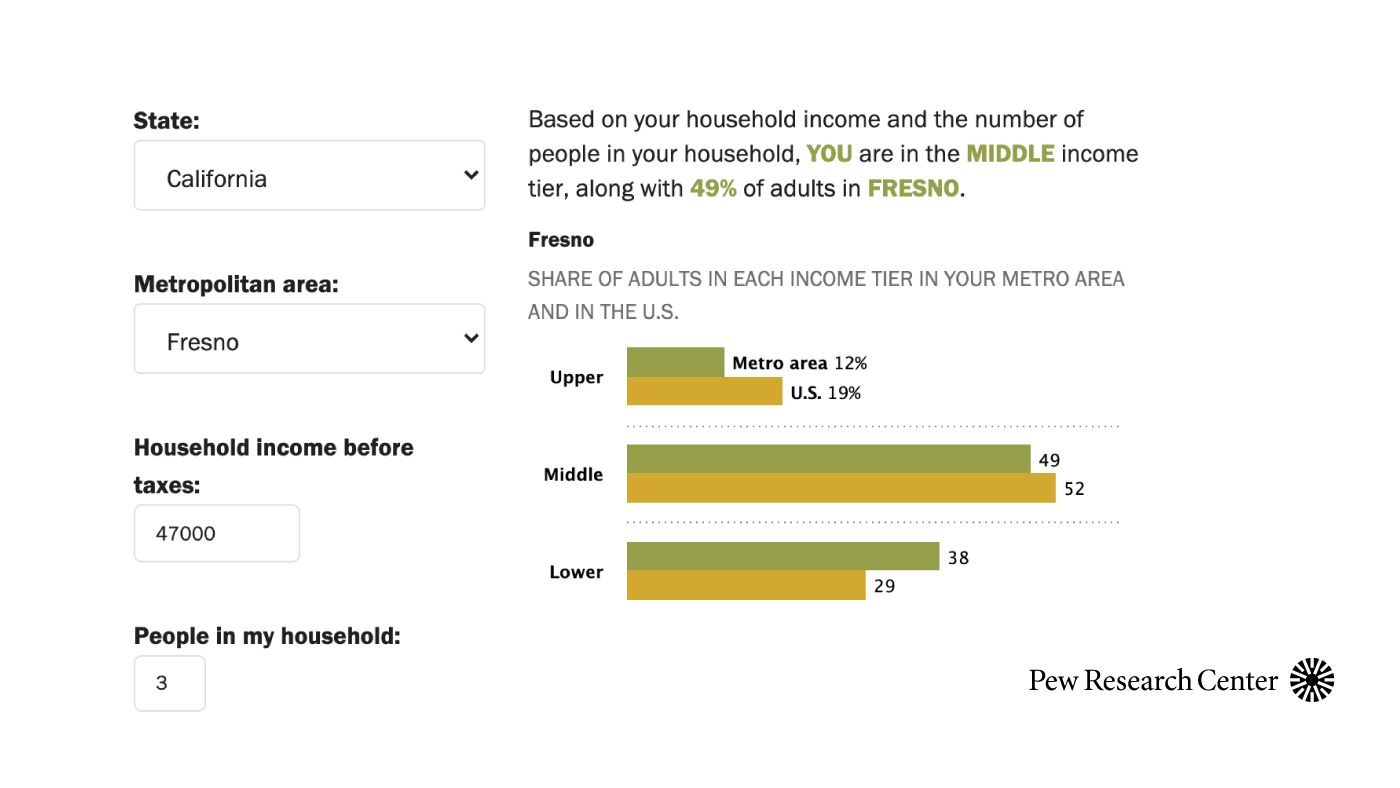

Are You In The U S Middle Class Try Our Income Calculator Pew Research Center

How To Calculate Iso Alternative Minimum Tax Amt 2021

Completing The Fafsa Office Of Student Financial Aid Iowa State University

Find Your Renewal Notice Iowa Tax And Tags

Salary Paycheck Calculator Calculate Net Income Adp

Iowa Farm Income Tax Webinar 2020

Iowa Income Tax Calculator 2022 2023

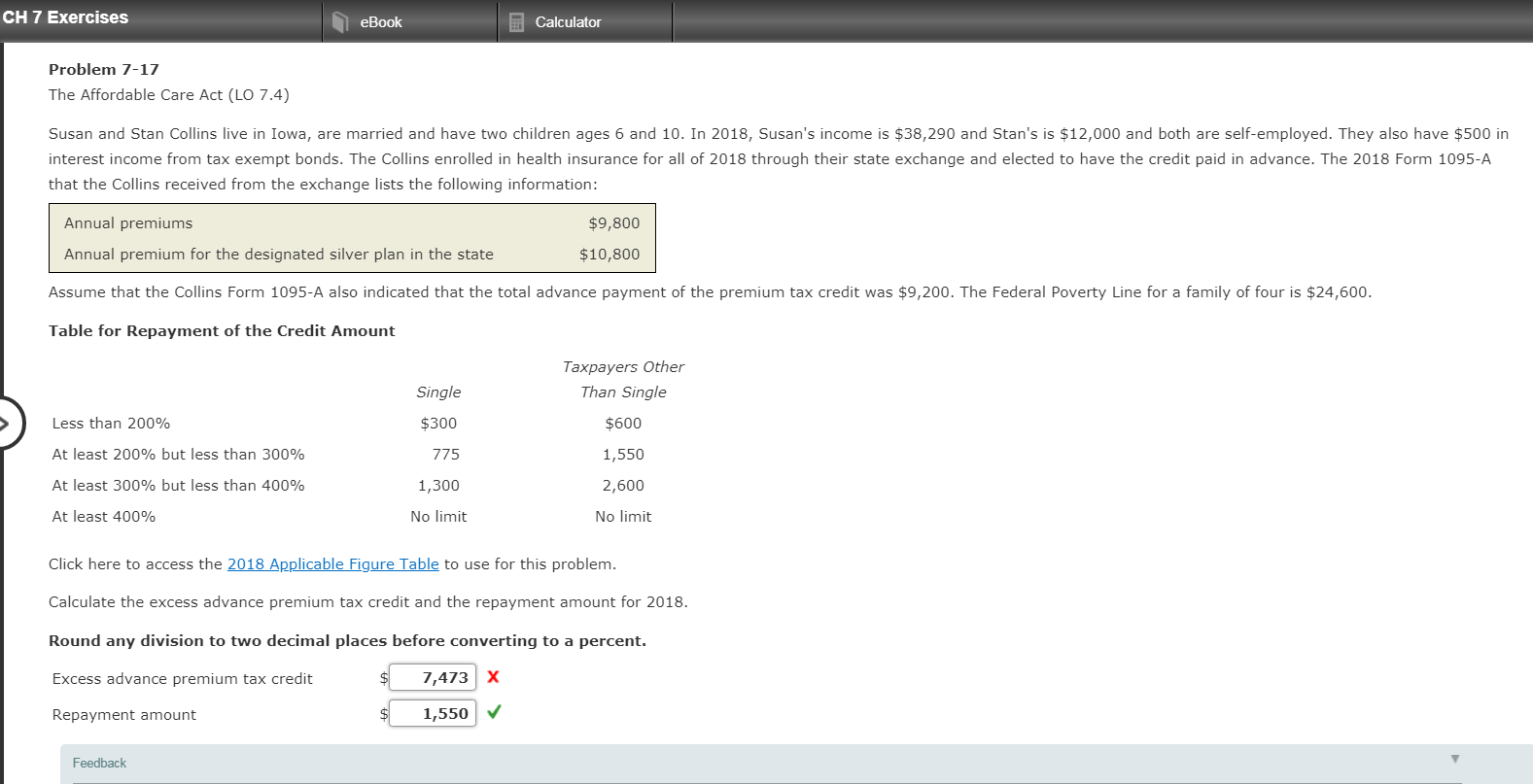

Ch 7 Exercises Ebook Calculator Problem 7 17 The Chegg Com

Changes In Sales Use And Excise Taxes In Iowa Uhy

Federal Income Tax Calculator Estimator For 2022 Taxes